The system's interlocking intricacies make it vulnerable not only to severe disturbance, but also to cascading failures that might end in a system unable to recover its former complexity and global reach, in other words, TEOTWAWKI. (For those who didn't get the memo, TEOTWAWKI stands for "the end of the world as we know it.")

Korowicz rightly depicts our global system, financial and logistical, as extremely complex, but not so complex that he cannot understand it enough to predict a disaster of unprecedented proportions sometime this decade. He acknowledges the remarkable resilience and self-healing our current global system has shown in the face of repeated insults in the last several decades, especially the crash of 2008. But, in a new report he outlines why he believes that that resilience has been significantly eroded and may well be tested to the breaking point in the next several years.

It comes down to this:

Complex interdependencies mean that a few critical points of failure could bring down the entire global system. Korowicz focuses on the banking system in which power and money have become highly concentrated. Reliable payment systems are what make worldwide trade and logistics possible. If trust in those systems breaks down (as it did at the end of 2008) and can't be restored, that's it for the global trading system. He cites other systems as well including our system of industrial production in which the just-in-time inventory model has been so broadly implemented that manufacturing and many services can grind to a halt within only a few says of a supply disruption.

Historically unprecedented indebtedness among households, businesses and governments has caused private credit creation, on which the growth of the global economy depends, to sputter. Those who can borrow don't want to for fear that the economy may continue to be sluggish, threatening their jobs or businesses. Those who are too indebted to borrow more are focused on repaying debt or simply deciding to default. We are in a debt deflation that threatens the very stability of the worldwide financial system which is exposed to so many bad or potentially bad loans.

With interest rates near zero in much of the world and governments overloaded with debt taken on from failing sectors of the economy, mostly banks and housing, there is little flexibility for policy action if another severe shock hits the global economy as Korowicz expects.

Our current system is now structured to respond not proportionally to any shock, but with increasing acceleration and with consequences that seem outsized given the initial insult. Think Greece.

The economic models that policymakers are using are based on very narrow conditions experienced since the end of World War II and don't take into account the extreme stresses now evident in the world economy. Such models have so far failed to explain the severity of the crash (which they did not anticipate) and the persistence of a subpar recovery despite historically unprecedented stimulus, both fiscal and monetary. Nor have these models resulted in policies that have effectively addressed the fragility of both the financial and physical economy.

Previous shocks--the Asian crisis of 1997, the Argentine collapse, Japan's long slump--have all been in the context a functioning world economy, strong elsewhere and able to give a lift to the countries battered by financial collapse or stuck in economic malaise. The next big crisis, Korowicz believes, may envelope the entire global economy or enough of it so that there will be no stable center that affected countries can rely on to trade with as they repair their economies.

Resource constraints, particularly an evident plateau in the worldwide rate of oil production from 2005 onward, is challenging the growth paradigm upon which all of our major systems are premised. These systems, financial and otherwise, are designed to be stable under conditions of persistent growth. Without that growth, their stability is unlikely to hold up. One example is the banking and credit system that depends on consistent economic growth to allow repayment of loans. That growth in turn depends on expanding energy supplies crucial to economic activity.

Perhaps the most disturbing conclusion Korowicz comes to is that the kind of collapse he envisions will not be reversible. Too much of the world's critical infrastructure, both public and private (industrial), will be impaired by lengthy shutdowns. Faith in payment systems will be gone and impossible to revive. Many businesses will simply shut down for lack of funds or customers and not be around to restart if conditions improve. Essentially, there is a point of no return that could put the world economy into a new equilibrium that is far less networked and global than it is today and from which it will be all but impossible to return.

This is the reason, of course, why government officials have made herculean efforts (with public money, of course) to keep the world's financial system going. But they have only given it stimulants, when what is needed is surgery. Naturally, those who control both the financial system and the politicians who regulate it are resisting that surgery since it would make them less rich (even if it would save them and us by making the system more stable).

Hence, Korowicz writes: "Our immediate concern is crisis and shock planning. It should now be clear that this is far more extensive than merely focussing on the financial system. It includes how we might move forward if a reversion to current conditions proves impossible." While he doesn't offer a set of responses in this paper, he promises to discuss them in his future writings.

While much of Korowicz's analysis is compelling and nuanced, I can't help but think he is overestimating the possibility of a wrenching collapse. I am reminded of a piece of artwork I saw recently at a gallery that was a representation of a house of cards--only the cards were stamped out of relatively thick plates of metal and securely attached to one another. From a distance it looked like a house of cards, and it was called a house of cards. But it did not, in fact, act like a house of cards.

And, so I think our modern complex system can be endlessly analyzed and shown to have frightening vulnerabilities. Our current global system looks to a thoughtful person like a house of cards. Now, I am willing to admit that even the sturdily built facsimile which I examined at the gallery could eventually be struck, rattled, cut, burned (with a torch perhaps), or otherwise have its integrity undermined. As a species we certainly seem be doing all we can to undermine the systems upon which we depend. So, I think it is possible that one day Korowicz's vision may indeed come true.

But the global system has shown both its vulnerabilities and its resilience. The people who rely on it--rich and powerful people--have not and will not sit still and do nothing as successive shocks from financial panic or resource depletion or war threaten its integrity. These people will fight and probably succeed at averting a total collapse in the medium term. That's what happened in late 2008 and early 2009. And, that's what will likely happen many times more as the vaunted global system stairsteps its way to lower complexity.

And, that process will have people telling us at each step of the way down (toward lower complexity) that things will return to "normal" any day now if we are just patient and have faith. That will frustrate those of us who believe rapid transformation is inevitable and that we would do well to plan for it. But, don't look for that frustration to abate anytime soon.

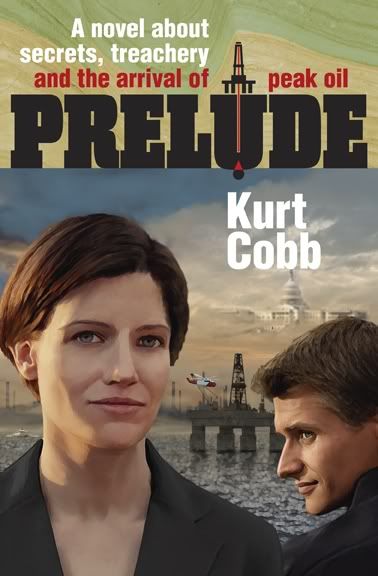

Kurt Cobb is the author of the peak-oil-themed thriller, Prelude, and a columnist for the Paris-based science news site Scitizen. His work has also been featured on Energy Bulletin, The Oil Drum, 321energy, Common Dreams, Le Monde Diplomatique, EV World, and many other sites. He maintains a blog called Resource Insights.

Kurt Cobb is the author of the peak-oil-themed thriller, Prelude, and a columnist for the Paris-based science news site Scitizen. His work has also been featured on Energy Bulletin, The Oil Drum, 321energy, Common Dreams, Le Monde Diplomatique, EV World, and many other sites. He maintains a blog called Resource Insights.

3 comments:

Having studied the curves of what we are committed to in terms of Climate Destabilization - and they include the ongoing acceleration of at least six of the interactive mega-feedbacks on warming - the loss of global cohesion and economic resilience due to a global collapse would in my view preclude the collective actions that are essential to halting that destabilization of the climate and so preventing serial global crop failures. (Note: no additional future emissions at all are required for climate impacts that severe).

If we fail to mitigate the timelagged effects of GHG emissions to date, the start of crop failures at the global level is possible this decade, probable in the next, and probably inevitable in the 2030s - as best I can understand the drivers' interactions. Very senior scientists are of the same general view. To put this in a human context, a food shortage gets compounded by a degraded capacity for collective response, viz the great medieval European famines, where a mere 10% to 15% food shortfall killed more than twice that fraction of the population.

Thus I continue to strive for fundamental 'perestroika', but I don't share the glee at the thought of global economic collapse - both for the above reason and also for the dire political prognosis - given the left's utter disarray under neo-liberalism and its lack of well mobilized public protest capacity (perhaps 100th of what it was in the '60s ?)

and given the historical record of the chaotic collapse of long-established regimes' directly empowering utterly brutal warmongering fascist replacement regimes. (Such regimes would not only inherit current arsenals but also the covert research into new WMD, while having dumped any notion of international law along with membership of the UN).

I suggest that for these and other reasons we need to achieve a sustainable collective global governance more urgently now than ever before in our history. Allow petty nationalism or pettier localism or popular absentionism to mess it up this time - and all bets are off.

Regards,

Billhook

I have two suggestions for preventing TEOTWAWKI, and thanks for the word.

Both involve understanding.

1. Cartesian Economics: The Bearing of Physical Science Upon State Stewardship

http://habitat.aq.upm.es/boletin/n37/afsod.en.html

2. The Role of Money

http://ia700306.us.archive.org/15/items/roleofmoney032861mbp/roleofmoney032861mbp.pdf

It's all about the relationship between real physical science and our monetary system.

As Nobelist Soddy said in conclusion of studying the money system: ""It's not a system; it's a confidence trick.""

It's about the paper that is about to destroy the planet as we know it. But, it's only paper.

Thanks.

Meh. Economics doesn't exist. Force does. "We're not shipping food, because we won't get paid!"

Guns come out, "No, you will deliver food or we will blow your fucking head off."

Food gets delivered.

"We're not selling oil because we don't like your currency."

Guns come out. Nations invaded. Oil flows.

"We're not lending money because it's all broken and we can't see a profit."

Guns come out, banks are nationalised, debt vanishes. Bankers are lined up and shot. Money gets lent.

TEOTWAWKI is not a bad or a good thing. There is only transformation. It is much better to measure Good or Bad against metrics like Democracy and Involvement on one end and comfort and longevity on another. There are a number of metrics one can use.

I read that thing by Korowicz and was appalled. Such a complete and stunning lack of imagination.

Post a Comment